It is your CIBIL score that makes all the difference when loaning money or applying for credit cards. But did you know that checking too often works negatively on your creditworthiness?

Read further in this article as we dig deep into all the rules laid down for you by the RBI, and explain how your CIBIL score works and a few tips that will help you maintain or improve it. Let’s clear up any misunderstandings and make sure you are doing the right things.

What is CIBIL Score?

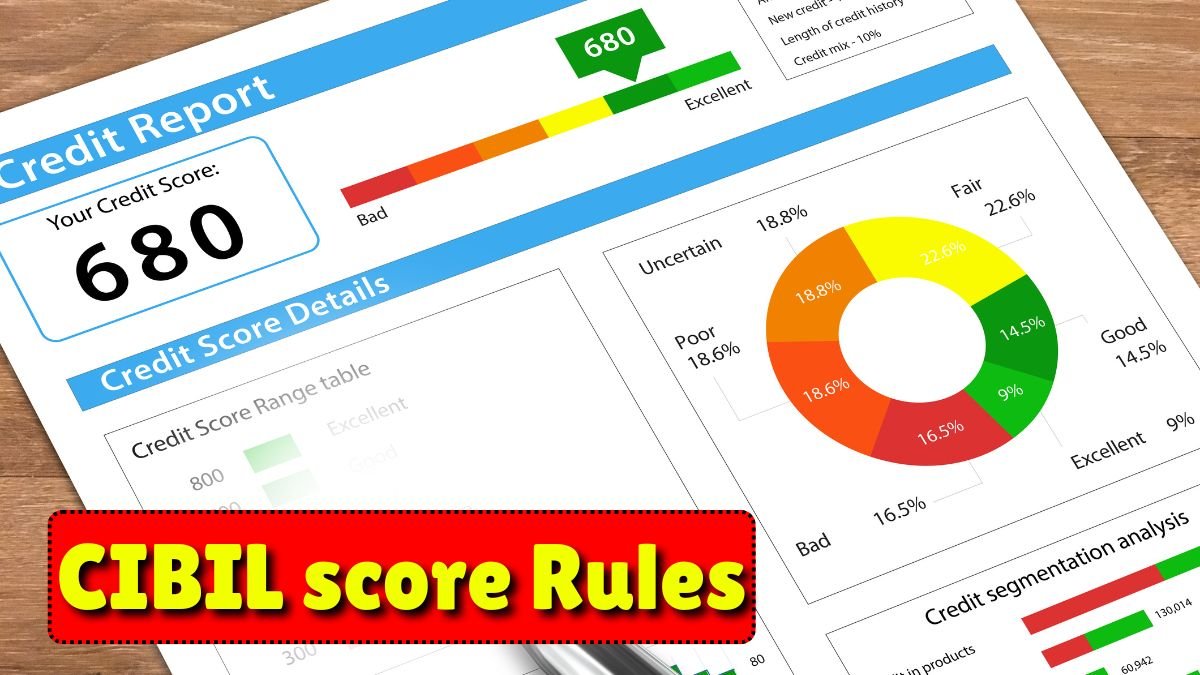

CIBIL Score is a three-digit number (300 – 900) denoting credit history and financial behaviour by a borrower. Institutions ascertain the score before granting loan approval or credit cards. A score above 750 would be considered good and could increase approval chances at lesser rates of interest.

However, many people do not know that it will ruin them if they repeatedly check the score. Let us explore the reasons behind it and what RBI says about it.

How Frequently Your CIBIL Score Is Updated?

As per new RBI guidelines, beginning January 1, 2025, CIBIL scores will now be updated after every 15 days. This means banks and FIs used to tap the update frequently in order to keep the latest information at hand while determining the application for loans.

It is helpful to speed up and make it more transparent. However, it calls for greater caution in how often you check your credit score.

- Soft vs. Hard Inquiry on improvement of credit score

All checks cannot be more or less alike. Here is the fundamental difference: - Soft Inquiry: A soft inquiry is when you check your own CIBIL score. It does not affect your credit score at all.

- Hard Inquiry: This happens when banks use your credit score during a credit or loan application, and are considered hard inquiries. A lot of hard inquiries in a short time can lower your CIBIL score.

RBI’s new policy on CIBIL score examinations

The RBI has also introduced amendments on acts about keeping the consumer protected from unnecessary damage by insufficient credit score. Such rules will apply to:

- The hard inquiries performed by banks and financial institutions must, however, be limited in number.

- Frequent hard inquiries, especially if they follow one another within a short time, would severely hit your CIBIL score.

- This is particularly important in case someone is applying for a loan or credit card too often. Each application gets into a hard inquiry, which cannot be tallied but becomes harmful to one’s creditworthiness.

Why does CIBIL score fall?

Many factors contribute to a low CIBIL score, and a few of these reasons include:

- Delayed or Missed Payments: Not repaying loans or credit card dues on time acts as a crucial reason for a low score.

- Increased Credit Utilization Ratio: Too much of your credit limit used can convey signs of financial stress.

- Frequent Loan Applications: Every one of those leads to a hard inquiry, thereby lowering your score.

- Being a Guarantor for the Loan: If the debtor defaults against the loan, it would also impact your score.

Ways to Check Your CIBIL Score Without Hitting It

You can ethically check your CIBIL score using:

- The official CIBIL website

- Any RBI-recognized institution

Keeping a tab on your score can actually help keep you abreast with your financial health. And, by the way, checking your own score is a soft inquiry and will not harm.