The Unified Pension Scheme (UPS) has been announced by the Central Government for the guaranteed pension for the employees after retirement. This scheme is scheduled to be rolled out from April 1, 2025, which guarantees a secure option against the NPS under which you don’t need to worry over market crashes, as your pension is going to be unaffected. Wondering about how much pension you can expect under UPS? This guide will help you to understand the calculation process at ease.

What is the Unified Pension Scheme (UPS)?

The UPS fund is intended to give monthly pensions that are assured to employees, thus freeing them from the vagaries of stock and debt markets. Whereas NPS attributes your pension to the performance of the markets, the UPS guarantees a minimum pension level normally starting from ₹10,000 per month. All in all, it proves to be a good and decent option for post-retirement security.

UPS Pension Calculation

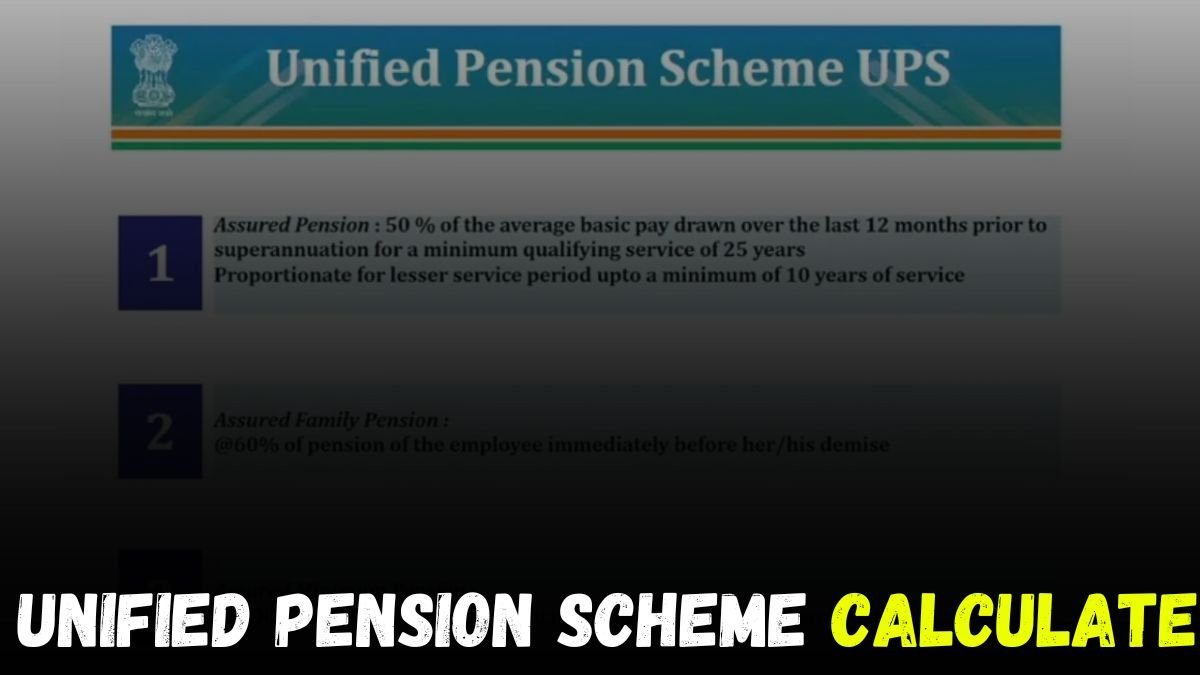

Under the UPS, the pension amount is calculated by using a simple formula:

Payout = 50% of X (Sum of 12 Months’ Basic Pay / 12)

The formula applies if the balance of service left is 25 years or more. In case the service is less than 25 years, then a proportional adjustment is made in the payout. For better understanding, let us illustrate the above with examples.

Example 1: Service of 25 Years or More

Suppose an employee has served for 25 years or more, and their average basic pay at retirement is ₹12,00,000 per year.

- Calculate the average monthly basic pay:

₹12,00,000 / 12 = ₹1,00,000 - Apply the formula:

50% of ₹1,00,000 = ₹50,000

In this case, the employee will receive a monthly pension of ₹50,000.

Example 2: Service of Less Than 25 Years

If an employee has served for 20 years, the payout is calculated proportionately.

- Calculate the proportionate factor:

20 years / 25 years = 0.8 - Apply the formula:

50% of ₹1,00,000 X 0.8 = ₹40,000

Here, the employee will receive a monthly pension of ₹40,000.

Example 3: Minimum Guaranteed Pension

If an employee’s basic pay at retirement is ₹15,000 per month, the calculated payout would be:

- Apply the formula:

50% of ₹15,000 = ₹7,500 - Since ₹7,500 is below the minimum guaranteed pension of ₹10,000, the employee will receive ₹10,000 per month.

Why Choose UPS Over NPS?

Once the UPS is operative, it provides financial and mental security, with a fixed pension irrespective of the market. This is beneficial for those who like an employee retirement plan to be devoid of risks.

Important Points to Remember

- The UPS comes into effect from April 1, 2025.

- No switching back to the NPS will be entertained upon acceptance for the UPS.

- This scheme suits those seeking a stable and secure income after retirement.